The astonishing profitability of the Search Funds

Posted by EH Staff in Uncategorized on December 8, 2021

For some years now, we have been witnessing an increase in the popularity of Search Funds promoted by professionals (Searchers) between 30 and 40 years old, with great potential and an entrepreneurial mentality to find, buy, operate and sell an SME a few years later.

These are young people who no longer want to work as employees. They are aware that it is easier, and much less dangerous, to buy a company than to create it, and they opt for the Searcher’s way.

The growth in the number of Search Funds in Europe is accelerating, leaving even interested investors with the desire. In other words, today, there is more money to invest in them than Searchers.

Why is that?

The success of the Search Companies model is backed by the excellent returns obtained by more than 620 Search Funds created worldwide.

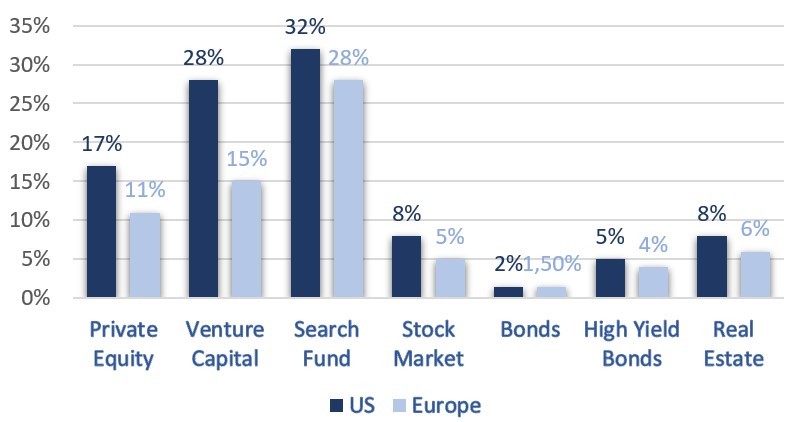

The $1.4 billion of capital invested in the USA and Canada in traditional Search Companies and their acquired companies have collectively generated an average annual IRR for investors of 32.6% until the end of 2019, multiplying by 5.5 times the capital invested. In the rest of the world, the average annual IRR for Search Companies is 28.7%.

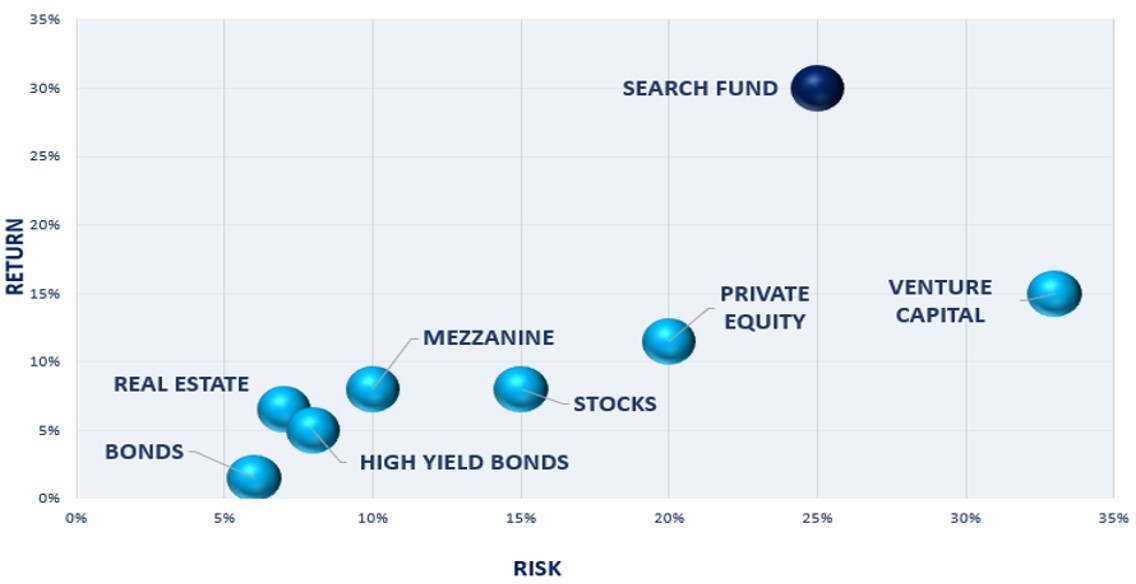

These figures make the Search Fund one of the best possible investment options.

Investment in Search Funds seems unbeatable in terms of profitability, but it is also unbeatable in the risk-return ratio.

How is this achieved?

The key to profitability for the investor lies in the fact that the Searchers:

(1) buy at an attractive multiple, thanks to the scarcity of buying competitors

(2) leverage 50% at meagre rates with bank and seller financing

(3) increase sales thanks to the Searcher’s commercial energy and international capabilities

(4) improve margins, as these types of companies are usually not optimized

(5) acquire other companies (add-ons) that change the company’s size

(6) apply a professional exit process of the company with M&A advisors and

(7) benefit from multiple arbitrages because they sell a company with a much higher EBITDA, and private equities compete for it bidding at higher prices.

There is no shortage of target companies. There are thousands of companies with EBITDA between 1 and 3 million euros (too small for private equity) with active owners who have passed retirement age in each country.

The S&P 500, as of December 31, 2020, was trading at a multiple of 18.1 times EBITDA. SMEs are being bought by Search Companies at an average of 5.6 times EBITDA.

It is clear that Search Funds are worth investing in and that there is still a lot of room for growth in this type of investment, which also has a low correlation with other assets.

The best Searchers (Class A Searchers) historically obtain the best returns. It is essential to maximize returns by gaining access to these Searchers and getting them to accept you as an investor.

Leave a comment