b2c eCommerce Brand Aggregators

The eCommerce market includes online sales of physical goods to a private end user (B2C). Included in this definition are purchases via computer as well as mobile purchases via smartphones and tablets. Excluded from the definition of ecommerceDB are the following: digitally distributed services (e.g., travel tickets), online stores dedicated to digital media downloads or streams, online stores dedicated to B2B markets, and sales between private individuals (C2C) within the eCommerce market.

Table of contents

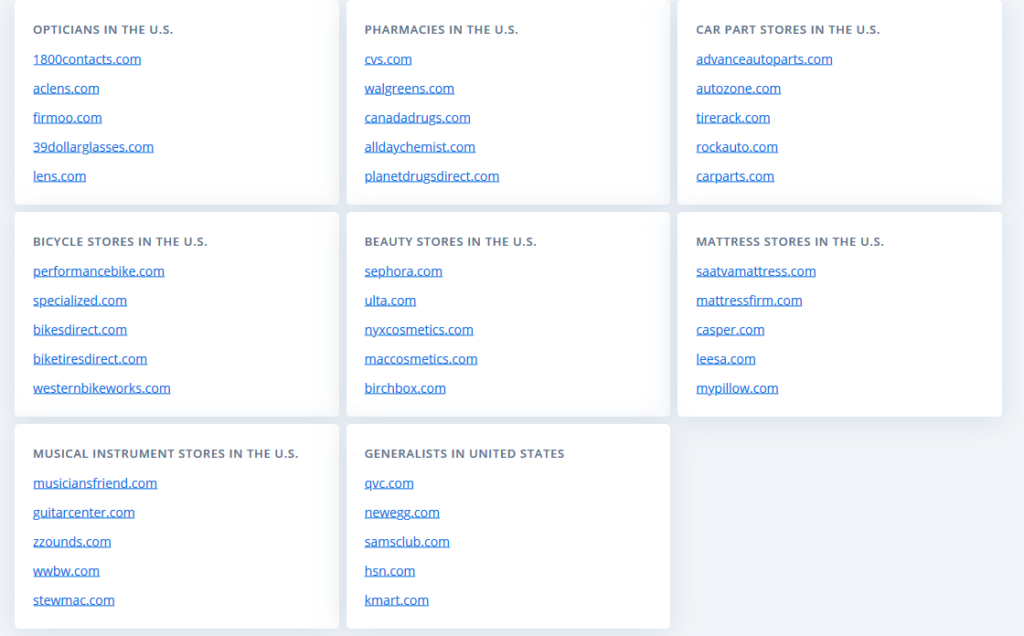

Top online stores

The biggest player in the U.S. eCommerce Market is amazon.com. The store had a revenue of US$73.7 billion in 2019. It is followed by walmart.com with US$19.6 billion revenue and apple.com with US$11.4 billion revenue. Altogether, the top three stores account for 30% of online revenue in in the United States.

Store rankings are based on every store that generates revenue in in the United States. These stores can either have a national focus and only sell in their main country or operate on a global scale. For this evaluation, only revenue created in in the United States was considered.

One of the fastest-growing stores in the U.S. market is perigold.com. The store achieved sales of about US$0.1 billion in 2019. Its revenue growth amounted to 137% in the previous year.

Market size and growth rate

Market expansion in in the United States is expected to continue over the next few years, as indicated by the Statista Digital Market Outlook. It has been predicted that the compound annual growth rate (CAGR 19-23) for the next four years will be 8%. Compared to the year-over-year growth of 11%, this decrease suggests a moderately flooded market. Another indicator of market saturation is the online penetration of 75% in in the United States; in other words, 75% of the U.S. population have bought at least one product online in 2019.

Five categories are considered by ecommerceDB. Fashion is the largest segment in in the United States and accounts for 30% of the eCommerce revenue in in the United States. This is followed by Electronics & Media with 22%, Toys, Hobby & DIY with 20%, Furniture & Appliances with 17% and Food & Personal Care with the remaining 10%.

Top shipping service providers

In in the United States, UPS (United Parcel Service) is the most frequently offered delivery service provider among online stores. Of those stores that indicating which service they use to transport their goods, 53% cited UPS (United Parcel Service) as one of their providers. Moreover, USPS (United States Postal Service) and FedEx are among the top three shipping service companies offered by online retailers in in the United States, at rates of 52% and 39%.

Shipping information is based on orders from the store’s main country, which is defined as the one where the store generates most of its online revenue. In this case, it is in the United States. Only stores that provide information about their shipping providers can be considered.

Explore the competitive marketplace