The Buzz Around Brand Aggregation

Posted by EH Staff in Uncategorized on November 3, 2021

In July 2020, Thrasio became the fastest US company to reach unicorn status. Does anyone know why they are named Thrasio?

In May 2021, Perch, another brand aggregator, set a new record for the fastest US company to achieve profitable unicorn status. Perch had then raised four times the largest ever Series A raised by a Consumer Goods Company. Fast forward four months, Berlin Brands Group, yet another brand aggregator, attained unicorn status.

Brand Aggregators are the eCommerce versions of Unilever, P&G, and Sony in that they acquire fast-growing digital businesses and scale them. According to Market Pulse, there are about 80 active brand aggregators across the world. Post-acquisition, the aggregators employ their expertise across supply chain, inventory management, and logistics to scale the brand and sell their products through multiple channels.

I have watched way too many drug-cartel-themed series to instantly salivate over the efficiencies. If the eCommerce aggregators are half as good as drug mafias in consolidating operations and running the show tightly, they and their investors will create great wealth for themselves and the brand founders.

The Year So Far for Brand Aggregators

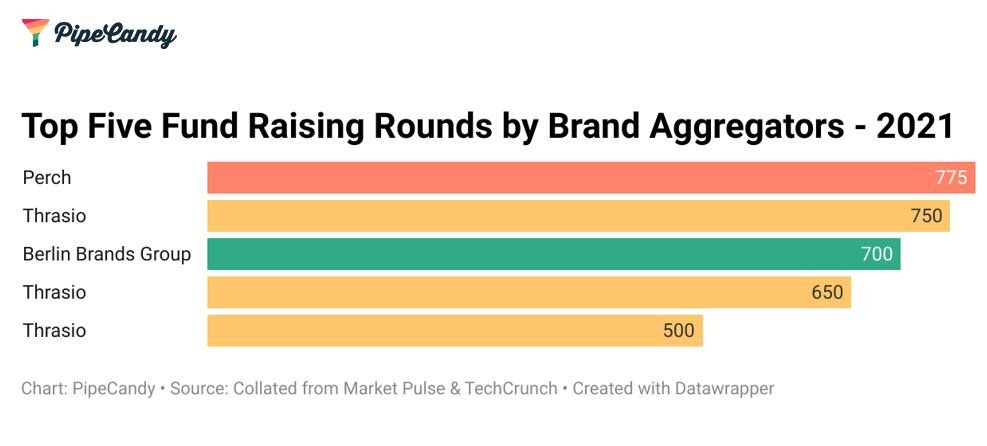

During the first nine months of 2021, about 40 brand aggregators have raised funds. Some of them have had multiple rounds. In 2020, brand aggregators spent around $1B in acquiring eCommerce brands. In the year so far, they have raised around $10B – 20% of the funds went to Thrasio alone. Perch became the first Consumer Packaged Goods company to raise as much as $775M in Series A.

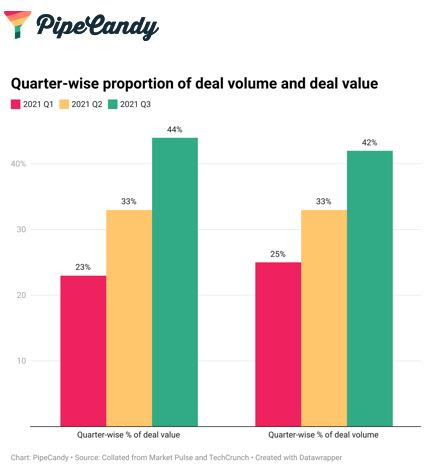

The number of deals and the aggregate value of deals increased with every quarter of 2021. About 50% of the fundraising deals were for more than $100M.

Major Brand Aggregators

Thrasio is the largest brand aggregator with $2.4B in funding. Founded in 2018, it has acquired around 200 Fulfilled by Amazon (FBA) brands. Having raised only half of the funds raised by Thrasio, Berlin Brands Group, a Germany-based brand aggregator is the second-largest brand aggregator in the world. Founded in 2005 (as a DTC brand), it focuses on FBA brands and D2C brands and has acquired 45+ brands so far.

The majority of the brand aggregators are from the USA. All brand aggregators are start-ups except for the Berlin Brands Group (BBG), which started as Chal-Tec which became BBG in 2018. Brand Aggregators in other parts of the world have only started in 2020. We also have brand aggregators originating in Asia (Rainforest and Una Brands), Latin America (Wonder Brands, Merama, and Valereo), and the Middle East (Opontia). For most of the brand aggregators, the Thrasio model is the holy grail.

All brand aggregators, like Thrasio, prefer to acquire FBA (Amazon) brands. In addition to FBA brands, some brand aggregators also acquire DTC brands. The most common threshold for these brands is to have had a revenue of more than $1M. But, that is not all. Different brand aggregators target Amazon sellers from different product categories. For example, BBG targets brands in garden, home and living goods, sports, electronics, and household appliances whereas Perch targets brands in Apparel & Beauty, Health & Wellness, Home & Kitchen, and Toys. And then, there are other conditions based on reviews and ratings, growth potential, and sustainability.

In the U.S.A, there are about 50,000 businesses on the Amazon platform that make more than $1M in sales; in the U.K, the number is just 3,000. Not all of these are investment-worthy. Amazon is crowded with sellers that buy wholesale and resell on Amazon. And, if the proportion of merchants that may be willing to sell and the categories that the brand aggregators may be interested in are considered, the number of eligible merchants is expected to be even lesser.

With many aggregators entering the roll-up race to build eCommerce versions of Unilever and P&G, the competition in the >$1M revenue range has been steadily increasing. It’s a bloodbath on the streets for market dominance. According to Thrasio, some eCommerce brands now trade at more than 6x their business value. Just a few years back, 2x was the norm. Recall that Thrasio was only founded in 2018. The acquisition cost has gone from 2x to more than 6x in a short span of three years. Considering the increased competition due to the amount of money that is being pumped into brand aggregators and the pace at which new brand aggregators are starting up, will brand aggregators still be able to acquire brands at reasonable valuations?

On one hand, it is incredibly hard to realize the promise of a shared platform for brands when they are all early-stage companies. On the other hand, investing in early-stage companies is the only way to achieve operational efficiency. This is evident in how aggregators are moving up the chain by acquiring stable brands or other smaller aggregators who would have/should have already done the work of streamlining. For example, Wonder Brands targets brands with at least $5M in revenue, and Rainforest targets firms in the sales range of $5M to $10M. An extreme case would be Perch’s acquisition of Web Deals Direct, an Amazon seller that owned 30 brands and made $80M in annual revenues. Besides targeting FBA brands, some brands (BBG, Perch, Boosted Commerce, Uny Brands from the list) are also diversifying into D2C brands on Shopify and WooCommerce.

Take the case of Solo Brands that has just filed for an IPO. Up until last month, it was just Solo Stove, a DTC brand, acquiring a couple of other DTC brands. Now, it is a holding company that has under its wings four DTC brands belonging to one narrow product category – Outdoor Living, in contrast to other brand aggregators who acquire brands from multiple and diverse product categories. The acquisition grants all portfolio brands access to all other brands’ customers. This could reduce Customer Acquisition Costs for all portfolio brands. Customer information is more precious now than ever, with the iOS updates granting customers more privacy. Also, focusing on one narrow category could make cross-selling and further expansions less expensive for each of the brands – be it setting up a physical store or expanding globally, or employing more channels.

Are aggregators able to live up to the promise of operational synergies? Will they survive the supply-chain apocalypse happening over the next two quarters? How much data would the aggregators have access to in closed systems like Amazon? Who is going to be the ‘Vista Private Equity’ of the aggregator world?

For both aggregators and lending companies, the times of advertising and supply chain squeeze provide the ultimate reset in valuations of their acquisitions but the question of “value prop” of aggregators is not going to go away soon.

The most visible evidence of coordinated execution, unfortunately, has been the exit of Thrasio’s senior team.

In the coming weeks, we will do our recon on the space, and how the models play out — all from the comfort of our armchairs.

PS: I am watching “Person of Interest” and hence the liberal street mob and special ops references. If you overlook Mr.Reese’s whispering tone even when he is not on the field, it’s a fantastic show.

Best,

Ashwin Ramasamy

Contribution: The research for the essay was contributed by Dr. Denila Jinny, Researcher at PipeCandy.

Leave a comment